risk in forex

You bet on the direction of the largest market in the world. In prop companies traders will get Risk management rules and for example it looks like this.

Risk Management For Forex Trading Beginners Ebook By Jose Pecunia Epub Rakuten Kobo United States

Determine your risk tolerance.

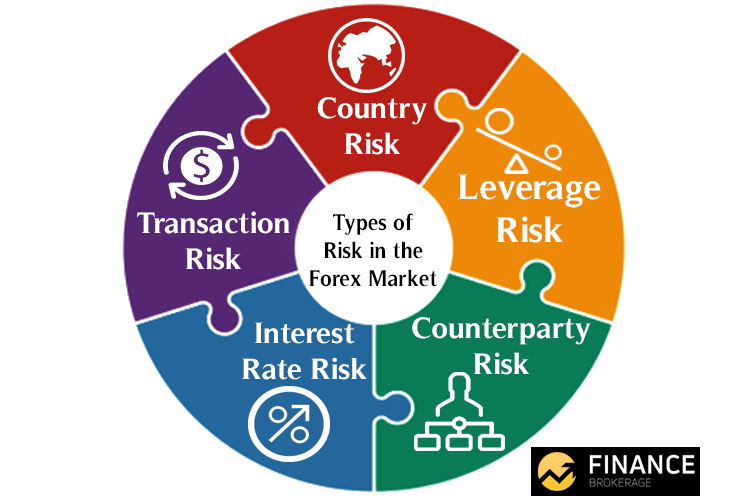

. The main risks in the Forex market include leverage liquidity and volatility. There are three main types of trading risk to be aware of. Any trading strategy no.

Within the realm of forex trading the meaning of risk management depends upon context. Market risk is the possibility that your trades will earn less than expected due to adverse. Practical risk management strategies in forex trading.

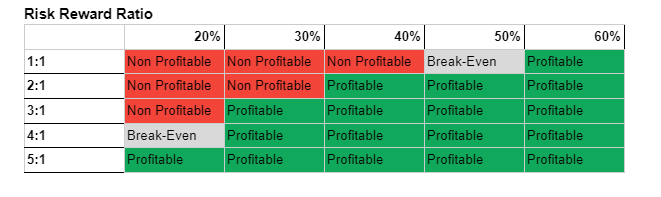

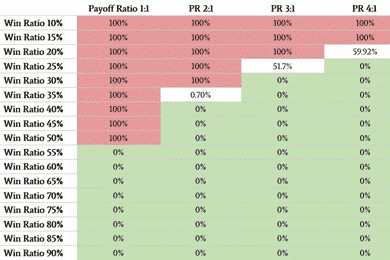

With 24-hour trading sessions. As it pertains to the trading plan the term refers to. The risk-reward ratio represents the amount of risk you intend to take for a given amount of profit or reward you expect to make on a given forex position.

A trader uses real money to earn real. Every trader though is concerned about losing money. Trade what you can afford to lose.

Forex risk management is a process of identifying assessing and controlling the threats that arise from foreign exchange. Forex Trading Risk is Always There. As an example if.

Any time differences allow exchange risks to fluctuate individuals and corporations dealing in currencies face increased and p See more. The Forex market is simple to navigate. 1 Do not fall below X relative.

By definition Forex is never risk-free. Rapid changes in rates as well as policy can add to the volatility of the forex market. 10 Forex Risk Management Strategies.

Transaction risks are exchange rate risks associated with time differences betweeThe greater the time differential between entering and settling a contract increases the transaction risk. There is no such thing as risk-free trading. Therefore understanding and managing Forex risks become a priority.

The rise and fall of interest rates impacts currency prices. Types of trading risk. The most appropriate leverage ratio to use in Forex is considered to be from 150 to 1200.

In four simple steps youll learn how to avoid risk. The most popular and golden rule of forex risk management is that you should risk only what you could afford to lose. The most important rule to manage risk in Forex trading is to use as your trading capital money you can afford to.

By Stjepan Kalinic Updated on. Interest rate risk. The four cornerstone risks in Forex trading are.

One of the skill needed when becoming. Risk Management in Forex Trading. As the forex market is.

Forex risk management is the cornerstone of trading the currency market.

Top 10 Forex Trading Risks That Currency Traders Should Evaluate Forex Training Group

The Forex Trader S Risk Management Checklist Vantage

Amazon Com Forex Money Management For All Currency Trading Strategies Risk Management Forex Forex For Beginners Make Money Currency Trading Foreign Trading Day Trading Ebook Zhang Alexander Kindle Store

Best Forex Risk Management Tools Plugit

How To Measure Risk In Forex Finance Magnates

Measuring Trade Risk Levels With Var And Cvar Forex Academy

The Best Forex Risk Management Practices

Foreign Exchange Risk Finance Brokerage

How Do I Make A Good Strategy And Risk Management In Forex R Forex

Is Trading Currency Safe Why Is Forex High Risk Quora

What Is Risk On Risk Off In Forex Trading Sentiment Analysis Basics Youtube

Trading Risk Management Top 10 Forex Risk Management Tips

Trading Risk Management Learn Effective Risk Management Techniques

How Do You Use 2 Rule Risk On Each Trade In Forex Freeforexcoach

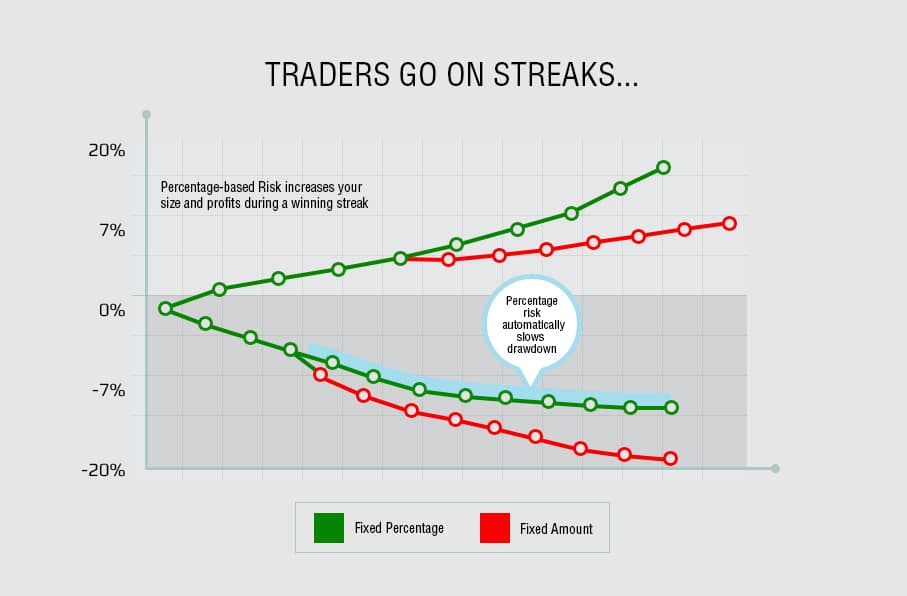

Fixed Equity Vs Fixed Dollar Amount Which Is Better 2nd Skies Trading

Forex Risk Management Tips And Strategies From Top Traders Litefinance

How Forex Brokers Manage Their Risk And Make Money Babypips Com

6 Trading Statistics Every Forex Trader Should Know 2nd Skies Trading